Lesson 3: DeFi Explained

Crypto World - Intermediate Level

← Back to TopicsWhat is DeFi?

DeFi stands for Decentralized Finance. It refers to a new financial system built on public blockchains like Ethereum and BNB Chain that removes banks and intermediaries.

Think of it like: banking without a bank — powered by code and community.

Key Features of DeFi

- Open access: Anyone with internet can participate

- Non-custodial: You control your own assets

- Permissionless: No KYC or approval needed

- Composability: DeFi apps work together like money Legos

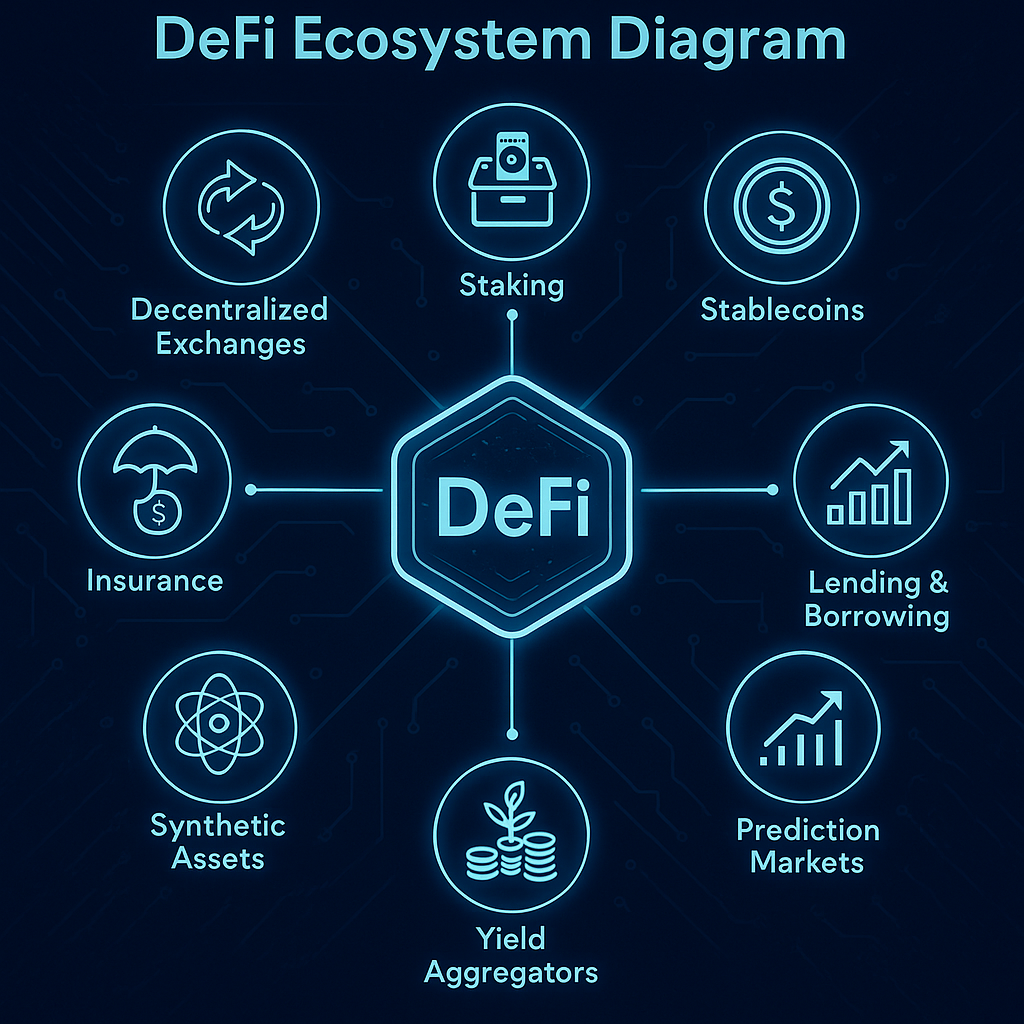

Popular DeFi Use Cases

- Lending & Borrowing: Platforms like Aave and Compound

- Decentralized Exchanges (DEXs): Like Uniswap or PancakeSwap

- Stablecoins: Such as DAI, USDC, BUSD

- Yield Farming & Liquidity Mining: Earn interest or tokens by providing liquidity

- Staking: Lock tokens to earn rewards and support network security

Benefits of DeFi

- Financial inclusion for the unbanked

- Transparency: all transactions are on-chain

- Global and 24/7 access

- Lower fees and faster settlements

Risks of DeFi

- Smart contract bugs or exploits

- Volatility in token prices

- Impermanent loss for liquidity providers

- Lack of regulation and protections

Next: We explore DAOs — decentralized organizations run by code and community.

Next Lesson →